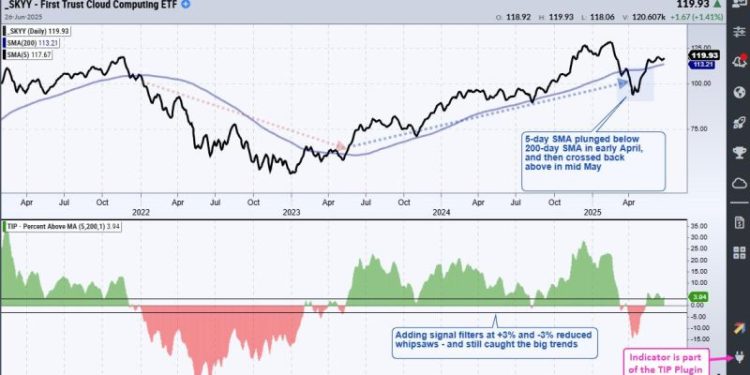

Chartists can improve their odds and increase the number of opportunities by trading short-term bullish setups within bigger uptrends. The first order of business is to identify the long-term trend using a trend-following indicator. Second, chartist can turn to more granular analysis to find short-term bullish setups. Today’s example will use the Cloud Computing ETF (SKYY).

***********************

, which has over a dozen reports. These cover the Zweig Breadth Thrust, trend-following signals, trailing stops and finding bullish setups. Check it out!

//////////////////////////////////////////////////